Investor’s guide to retirement planning

How IRAs can help you work towards your retirement goals.

February 5, 2026

Retirement might feel far away, but planning for it early on and understanding your options can make a big difference in being able to achieve the lifestyle you want to lead. Here are some basics to help get you going and make more informed choices.

Why invest for retirement?

The government offers Social Security retirement benefits that provide monthly income based on your work history and earnings. While it may help, most retirees find it’s not enough to support themselves and live the way they’d like to.

That’s why saving money for retirement is so important. And by investing what you set aside, you give that money more potential to grow over time and increase your financial security when you stop working.

Starting early and the power of compound growth

The earlier you begin investing for retirement, the better. Why? Because of compound growth--the idea that when your money grows, the new money you’ve made can also grow. This snowball effect means the longer it’s invested, the faster it can grow.

Although investing and compounding may help you grow your money, please remember that investing involves risk. You could lose money, investment returns are likely to fluctuate, and investing on a regular basis does not ensure you’ll make more money. These examples are hypothetical and don’t reflect the performance of any specific investment. *This hypothetical example assumes the following: (1) a $1,000 contribution is made on January 1 and every year from age 25 to 65 and age 35-65, respectively. (2) an annual rate of return of 7%, and (3) the ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. Illustrations with a 7% rate of return also come with risk of loss. **This hypothetical example assumes the following: (1) a $1,000 contribution is made on January 1 and every year from age 35 to age 65, (2) an annual rate of return of 7%, and (3) the ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower.

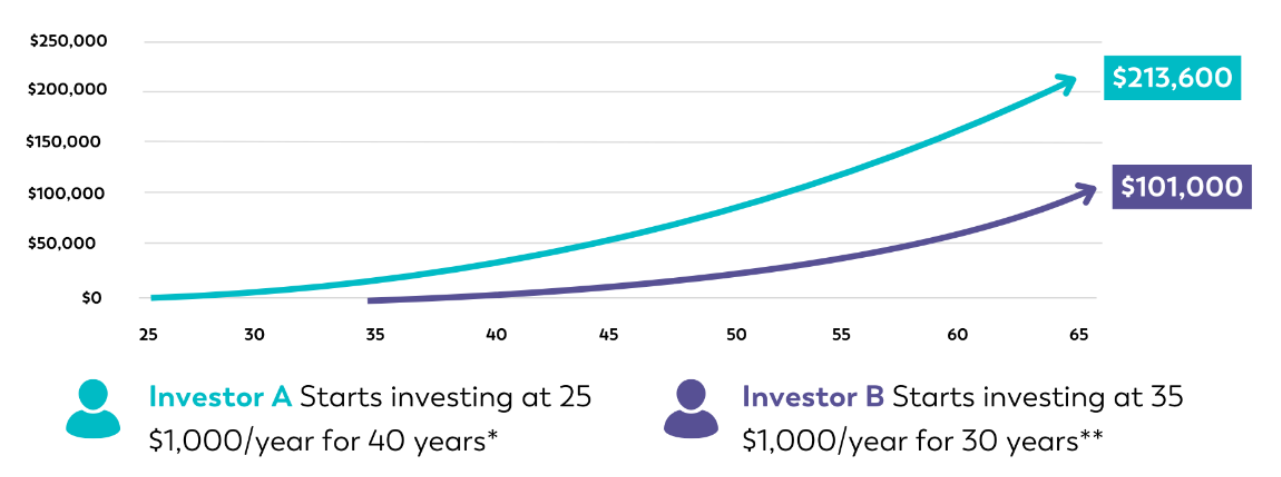

Check out this hypothetical example which shows the difference even a decade can make. Investor A starts at age 25 and invests $1,000 per year for 40 years until age 65. Investor B does the same thing, but begins 10 years later and invests for 30 years instead of 40. If both their investments grow an average of 7% per year, at age 65 Investor A has more than double the amount of money.

For Investor B to reach that same total after starting 10 years later, they’d have to invest more than twice as much each year.

401(k) vs IRA: What’s the difference?

Two of the most common retirement accounts are 401(k)s and IRAs. They both offer tax advantages that can help you save more money for when you retire. In many cases people may have more than one.

- 401(k): Offered through employers. You can contribute pre-tax dollars (meaning you don’t pay income taxes now on the money you contribute), and many employers have programs where they also match a portion of your contributions. Yearly contribution limits (the amount you can put away) are higher than IRAs, but your investment options are often limited by what’s available in your employer’s plan.

- IRA (individual retirement account): Opened on your own through a financial institution or investing app like Plynk. IRAs give you flexibility to choose a greater variety of investments and are worth considering if you don’t have a 401(k) or want to save more beyond your employer plan.

Read more: IRA questions and answers

Traditional IRA vs Roth IRA

Traditional and Roth are two basic types of IRAs. The biggest difference between the two is whether you save money on taxes now or later.

- Traditional IRA: Contributions can be tax-deductible now (made with pre-tax dollars) if you don’t have a 401(k) through your employer, but your withdrawals are taxed in retirement.

- Roth IRA: Contributions are taxed now (made with after-tax dollars), but in retirement you can withdraw your earnings tax free. Roth IRAs also offer additional financial flexibility because you can withdraw your contributions at any time with no penalty.

When choosing between a traditional or Roth IRA, something to consider is whether you expect to be in a higher or lower tax bracket when you retire. That can help you decide if you’d rather save on taxes now or in the future.

Read more: Traditional vs Roth IRAs

IRAs and your retirement goals

Retirement planning doesn’t have to be intimidating. Putting money in an IRA can be a simple way to get started and has the potential to be a powerful tool for long-term savings and investing. IRAs offer tax benefits, flexibility, and a wide range of investment choices. By contributing regularly and starting early, you can take advantage of compound growth and build towards a comfortable retirement.