How to set up automatic investing

Automatic investing can help you streamline your financial decision-making and put good money habits into action.

April 18, 2024

If you’re looking to grow your money, one strategy that can help you succeed is automatic investing.

What is automatic investing?

Automatic investing makes scheduled investments on a regular basis. You simply choose when, where, and how much to invest, and the rest of the work is done for you.

With the Plynk app, you can automatically invest your money in stocks and funds. By investing consistently, you’re putting good financial habits into action and eliminating the chore of remembering to make new investments. That's one thing you can take off your to-do list!

If you have a retirement savings plan through your employer, such as a 401(k) or a 403(b), you may already be familiar with this concept. Automatic investing with the Plynk app (although different than a retirement account) uses the same easy approach and gives your money the potential to grow faster over time in the investments of your choice. It also helps you implement a common investing strategy called dollar-cost averaging.

Auto investing with the Plynk app

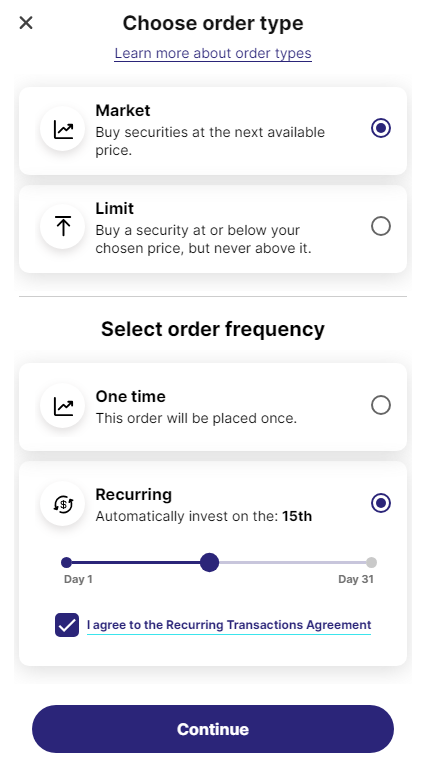

When you buy a stock or fund you're given the option of a one-time purchase or recurring investments.

To set up automatic investments:

- Choose the stock or fund you want and tap Buy now

- Enter a specific dollar amount you’d like to invest

- Click on Market in the upper right corner of the screen (recurring investments are only available with dollar-based market orders)

- Select Recurring and pick how often to invest

Then read and check the box for the Recurring Transactions Agreement, review your order, and you’re all set!

Next steps to consider

If you haven’t already, finish the process of automatic investing by setting up recuring deposits. Need help choosing investment ideas? Try Plynk Explore.